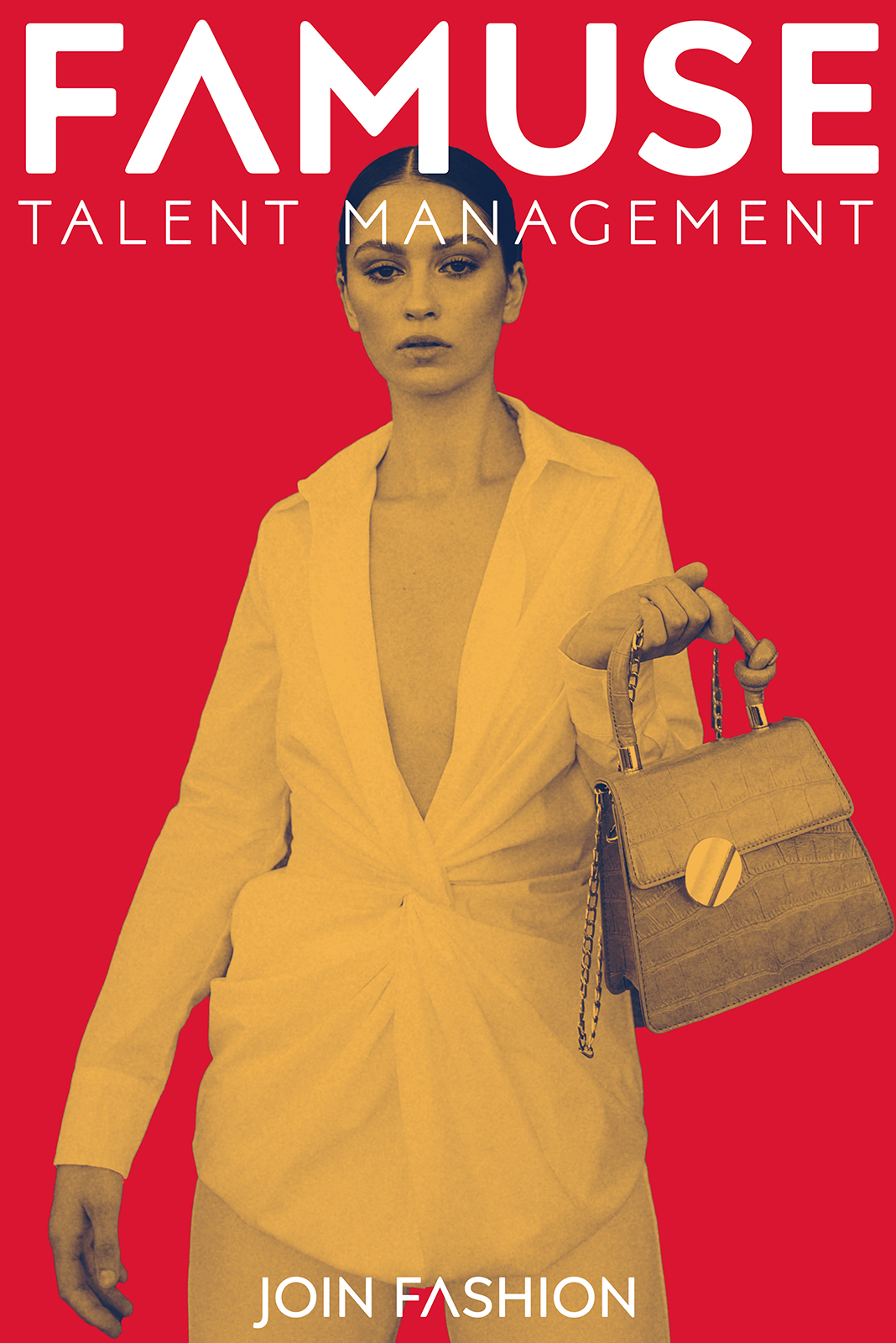

اسحب لتعديل الصورة

A tax and estate lawyer specializes in legal matters related to taxation and the management of estates. They provide guidance on tax planning, helping individuals and businesses minimize tax liabilities while ensuring compliance with tax laws. Additionally, they assist with estate planning, including drafting wills, trusts, and powers of attorney, to ensure that a person’s assets are distributed according to their wishes after death.

- المعلومات العامة

- 0 المشاركات

- https://srislawyer.com/estate-tax-lawyer-virginia/

- أنثى

الصور

لا يوجد منشورات

الغاء الصداقه

هل أنت متأكد أنك تريد غير صديق؟

الإبلاغ عن هذا المستخدم

مهم!

هل تريد بالتأكيد إزالة هذا العضو من عائلتك؟

لقد نقزت Aahanas

تمت إضافة عضو جديد بنجاح إلى قائمة عائلتك!

اقتصاص الصورة الرمزية الخاصة بك

© 2025 Famuse Management